The property market in The Midlands and Birmingham is almost at the crest of its wave, inching towards its inevitable trough.

Across the UK as a whole, mortgage approvals in October were at the highest rate since September 2007, according to the Bank of England. This is 50pc higher than they were in October last year, and marks the first time that the value of these loans has topped £20bn in a single month.

Capital Economics, the UK analysis firm, said that if this level is sustained for the next two months, total mortgage approvals in 2020 will exceed that of last year, despite the fact that the market was shut down for two months from mid-March.

This is an extraordinary situation: the gloomy economic outlook has had little effect on people’s willingness or ability to borrow huge amounts of money. It underlines the power of both the psychological impact of lockdown and the tantalising allure of saving on your tax bill– as well as the perception that interest rates will stay low for a while.

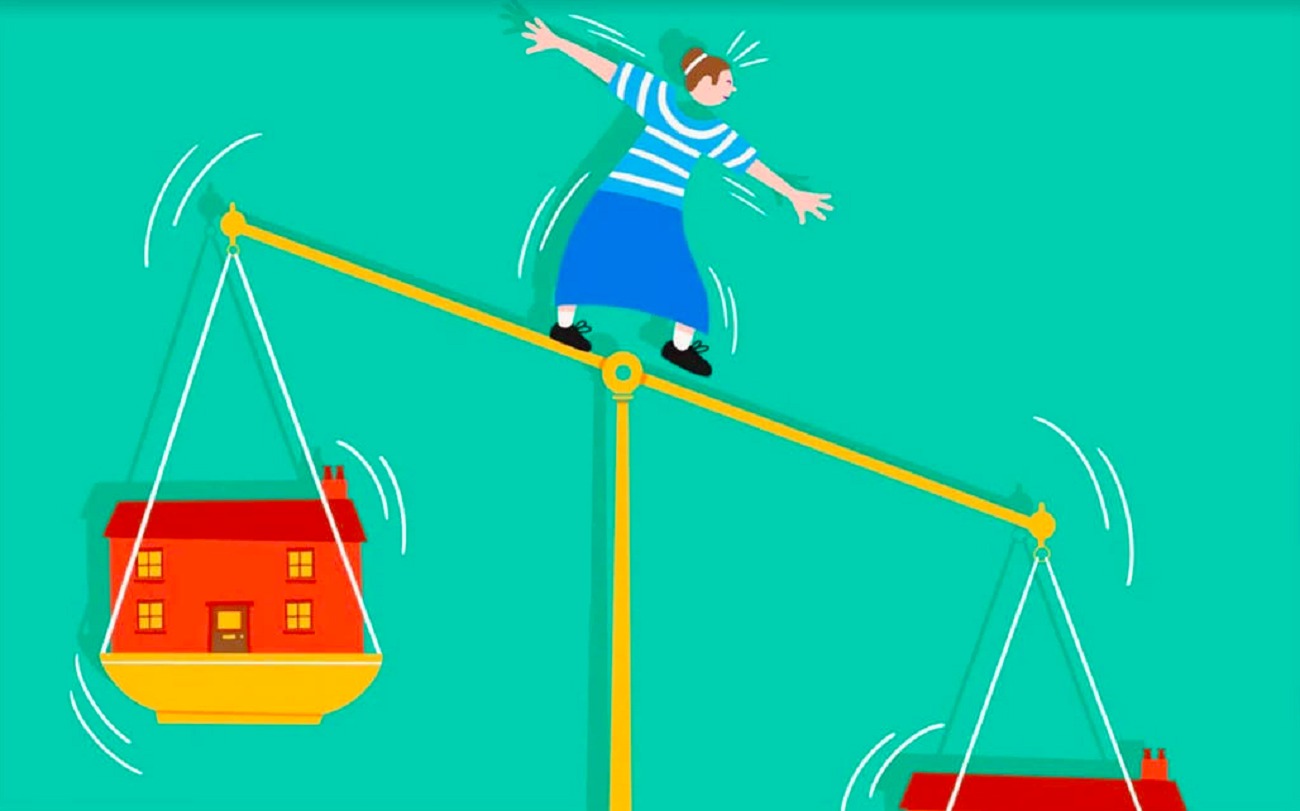

Capital Economics has forecast that when the stamp duty holiday ends, transactions will fall to a level that is almost as low as it was in the doldrums of the first lockdown.

The number of sales could tumble near to where it was when the market was closed for business – when the Office for National Statistics suspended its price index because the number of transactions was too low to get accurate data – is astonishing.

The end of the holiday will coincide with the end of the previously-extended furlough scheme, a hike in stamp duty for non-British residents and the tapering of the Help to Buy scheme that will narrow the number of people and places that can take part.

This means that the cliff edge come April may be worse than many experts feared. Capital Economics has suggested that if the stamp duty holiday is not extended, the surge in transactions and prices this year will be reversed in 2021. Different regions throughout the country will be affected differently. With Birmingham currently being one of the fastest growing property markets in terms of house prices, will it still continue to peak, or will it have the furthest to fall?

For free, impartial and friendly advice on how to make the most of the time left before the stamp duty holiday ends, please contact Love Your Postcode Estate Agents. Get an instant free property valuation in Birmingham and find out how much your house is worth today using our professional estate agents’ services.

By